CS Executive Tax Important Chapters. In the previous post, we have given CS Executive Tax Free Video Lectures. Today we are providing important chapters of CS Executive Tax Laws and Practice .Scroll Down

Best CS Executive Tax Laws Video Lectures

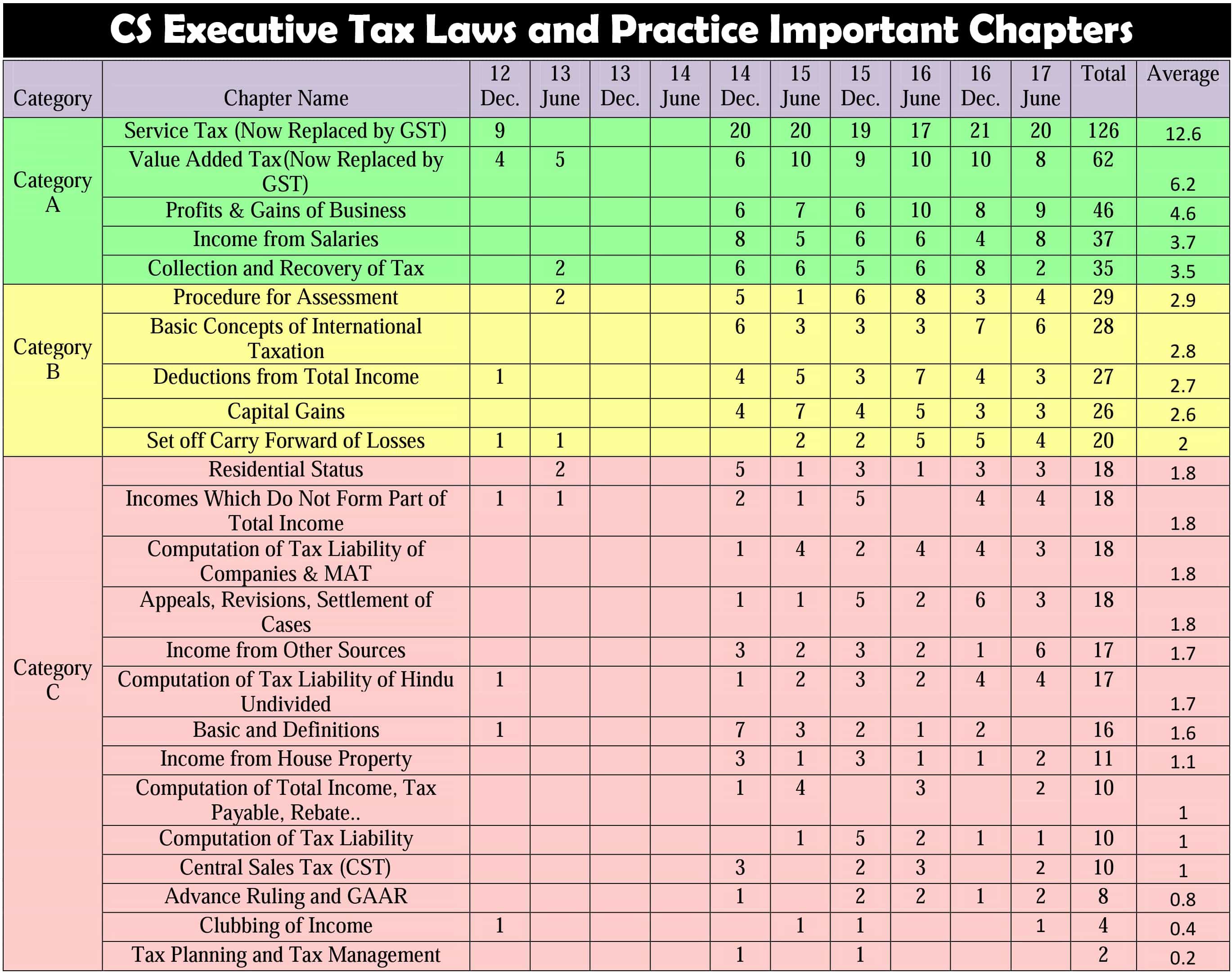

| CS Executive Tax Important Chapters | ||

| Category |

Chapter Name |

Average of Last 10 Attempts |

|

Category A |

Service Tax (Now Replaced by GST) |

12.6 |

|

Value Added Tax (Now Replaced by GST) |

6.2 |

|

|

Profits & Gains of Business |

4.6 |

|

|

Income from Salaries |

3.7 |

|

|

Collection and Recovery of Tax |

3.5 |

|

|

Category B |

Procedure for Assessment |

2.9 |

|

Basic Concepts of International Taxation |

2.8 |

|

|

Deductions from Total Income |

2.7 |

|

|

Capital Gains |

2.6 |

|

|

Set off Carry Forward of Losses |

2 |

|

|

Category C |

Residential Status |

1.8 |

|

Incomes Which Do Not Form Part of Total Income |

1.8 |

|

|

Computation of Tax Liability of Companies & MAT |

1.8 |

|

|

Appeals, Revisions, Settlement of Cases |

1.8 |

|

|

Income from Other Sources |

1.7 |

|

|

Computation of Tax Liability of Hindu Undivided Family |

1.7 |

|

|

Basic and Definitions |

1.6 |

|

|

Income from House Property |

1.1 |

|

|

Computation of Total Income, Tax Payable,Rebate |

1 |

|

|

Computation of Tax Liability of Individual |

1 |

|

|

Central Sales Tax (CST) |

1 |

|

|

Advance Ruling and GAAR |

0.8 |

|

|

Clubbing of Income |

0.4 |

|

|

Tax Planning and Tax Management |

0.2 |

|

Scroll Down for Detailed analysis and Tips for Preparing CS Executive Tax Laws

Best CS Executive Tax Laws Video Lectures

CS Executive Tax Important Chapters

CS Executive Tax Important Chapters : Important Chapters of CS Executive Exam

Here we are providing subject wise important chapters to CS Executive students. See below How to prepare CS Executive Module – 1 and Module – 2. Click below links

Module – 1

CS Executive Cost and Management Accounting

CS Executive Economic and Commercial Laws

CS Executive Tax Laws and Practice

Module – 2

CS Executive Company Accounts and Auditing Practices

CS Executive Capital Market and Securities laws

CS Executive Industrial labour and General Laws

Article Name : CS Executive Tax Important Chapters