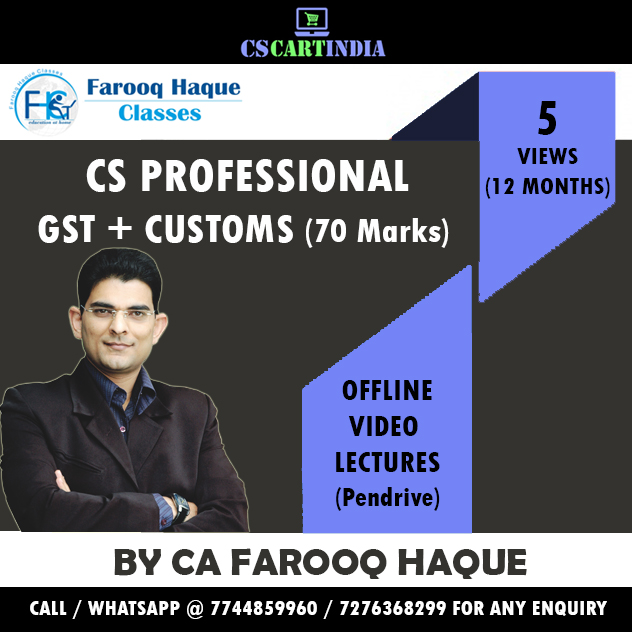

| CS Professional GST Video Lectures by CA Farooq Haque | |

| Format | Pendrive |

| Duration | 110 Hrs Approx |

| Video Language | English, Hindi |

| Faculty Name | CA Farooq Haque |

| Course Material Language | English |

| Video Runs On | Windows Based Computer, Laptop |

| Package Details | Video Lectures with Printed Notes |

| Sold & Dispatched By | Farooq Haque Classes |

| Views | 5 Views |

| Exams | CS Professional December 2018 |

| Validity | 12 Months |

| Delivery | Home Delivery within 7-10 days from the date of Payment Confirmation |

| Dispatch | Pen Drive will be dispatched within 24 to 48 Hours after the purchase |

| Minimum system requirements: Core 2 Duo, 2 GHZ and above CPU, 2GB Ram, Win 7 Home Premimum and above. No Win 7 Home Basic. | |

Note : Student will have to send Scanned Copy of Enrollment documents after making payment

- ICSI Identity Card

- Last Attempt Marksheet

Course Coverage :

| CS Professional GST & Customs | |

| Lectures | Duration |

| Customs Duty and FTP | |

| 01. Introduction to Customs Duty | 01.15.28 |

| 02. CVD of Excise to Education cess | 00.54.27 |

| 03. Protective and Safeguard Duty | 00.51.20 |

| 04. Auxilary Duties | 01.53.09 |

| 05. Definitions | 02.17.21 |

| 06. Officers | 00.41.47 |

| 07. Classification of Goods | 01.05.55 |

| 08. Levy and Assessment of Duty | 02.10.07 |

| 09. Remission of Duty | 00.51.08 |

| 10. Valuation Part 1 | 02.00.23 |

| 11. Valuation Part 2 | 01.26.16 |

| 12. Valuation Part 3 | 00.50.06 |

| 13. Problems on Valuation | 01.00.27 |

| 14. Import Export Procedure | 01.44.52 |

| 15. Transit and Transhipment of goods | 00.16.38 |

| 16. Warehousing of goods | 02.42.48 |

| 17. Duty Drawback | 01.56.24 |

| 18. Special Provisions | 01.07.17 |

| 19. Baggage Rules 2016 | 00.38.45 |

| 20. Exemptions and Refunds | 01.18.24 |

| 21. Recovery of Tax | 01.01.22 |

| 22. Adv Ruling and Set Com | 01.15.37 |

| 23. Appeals and Revision | 01.43.52 |

| 24. Search and Seizure | 00:47:35 |

| 25. Confiscation and Penalties | 01:12:34 |

| 26. Offences and Prosecution | 00:53:22 |

| 27. Miscellaneous | 00:39:09 |

| 28. FTP part 1 | 01.42.00 |

| 29. FTP part 2 | 02.22.29 |

| Goods & Service Tax | |

| 01. Introduction Part 1.mp4 | 01:28:35 |

| 02. Introduction Part 2.mp4 | 00:55:39 |

| 03. Constitutional Provisions.mp4 | 01:07:39 |

| 04. Definitions Part 1.mp4 | 01:10:45 |

| 05. Definitions Part 2.mp4 | 01:54:36 |

| 06. Administration.mp4 | 00:15:50 |

| 07. Sec 7 Scope Of Supply.mp4 | 01:30:26 |

| 08. Schedule I Deemed Supply.mp4 | 00:44:00 |

| 09. Schedule II Supply of Goods or Service.mp4 | 01:04:01 |

| 10. Schedule III Not a Supply of Goods or Service.mp4 | 00:11:11 |

| 11. Sec 8 Composite and Mixed Supplies.mp4 | 00:25:20 |

| 12. Sec 9. Levy Of Tax.mp4 | 00:53:32 |

| 13. Exemptions Part 1.mp4 | 01:23:45 |

| 14. Exemptions Part 2.mp4 | 00:58:48 |

| 15. Exemptions Part 3.mp4 | 01:20:41 |

| 16. Exemptions Part 4.mp4 | 00:44:20 |

| 17. Exemptions Part 5.mp4 | 01:28:26 |

| 18. Rates of GST.mp4 | 00:44:20 |

| 19. Sec 10 of IGST Place of Supply of Goods in India.mp4 | 01:16:42 |

| 20. Sec 11 of IGST Place of Supply of Import Export Goods.mp4 | 00:03:40 |

| 21. Sec 12 of IGST Place of supply of Service in India.mp4 | 01:43:08 |

| 22. Sec 13 of IGST Place of Supply of Service where Supplier or Recipient is Outside India.mp4 | 01:13:01 |

| 23. Sec 13 of IGST Analysis.mp4 | 00:54:03 |

| 24. Sec 14 of IGST Person Liable for OIDAR Service.mp4 | 00:41:01 |

| 25. Sec 12 of CGST Time of Supply of Goods.mp4 | 01:49:34 |

| 26. Sec 13 of CGST Time of Supply of Service.mp4 | 01:21:28 |

| 27. Sec 14 of CGST Time of Supply in case of change in Rate of Tax.mp4 | 00:58:29 |

| 28. Sec 15 of CGST Value of Supply.mp4 | 00:58:31 |

| 29. Rules 27 to 31 of CGST Value of Supply.mp4 | 00:58:53 |

| 30. Rule 32 of CGST Deemed Value of Supply.mp4 | 01:42:08 |

| 31. Analysis of Sec 15.mp4 | 00:32:53 |

| 32.Rules 33 to 35 of CGST Value of Supply | 00:14:31 |

| 33.Composition Scheme | 01:49:45 |

| 34.Reverse Charge Mechanism | 01:19:26 |

| IGST Sec 5 and 6 | 00:30:56 |

| 36. IGST Sec 7 to 9 | 00:40:07 |

| 37. Zero Rated Supply | 01:09:11 |

| 38. Apportionment of IGST | 00:39:40 |

| 39. ITC Part 1 | 01:16:17 |

| 40. ITC part 2 | 00:24:26 |

| 41. ITC part 3 | 00:27:06 |

| 42. ITC part 4 | 01:10:03 |

| 43. ITC part 5 | 00:45:18 |

| 44. ITC part 6 | 00:31:10 |

| 45.ITC part7 | 00:27:32 |

| 46. ITC part 8 | 00:24:09 |

| 47. ITC part 9 | 00:31:32 |

| 48. ITC part 10 | 00:22:27 |

| 49. ITC part 11 | 00:56:38 |

| 50. Registration part 1 | 01:00:00 |

| 51. Registration part 2 | 00:45:51 |

| 52.Registration part 3 | 00:37:48 |

| 53. Invoice etc | 01:14:51 |

| 54. Accounts and Records | 00:29:21 |

| 55.Payment of Tax | 01:05:59 |

| 56. TDS and TCS | 00:45:01 |

| 57. Returns part 1 | 01:12:18 |

| 58. Returns part 2 | 00:18:54 |

| 59. Returns Part 3 | 01:02:19 |

| 60. Returns part 4 | 00:22:01 |

| 61. Refund part 1 | 00:58:57 |

| 62. Refund part 2 | 00:55:43 |

| 63. Refund part 3 | 00:20:50 |

| 64. Refund part 4 | 00:45:29 |

| 65. Assessments | 00:33:47 |

| 66. Audit | 00:17:58 |

| 67.Inspection Search Seizure And Arrest Part 1-1 | 01:25:30 |

| 68.Inspection Search Seizure And Arrest Part 2-1 | 00:07:51 |

| 69. Advance Ruling-1 | 00:36:45 |

| 70 Demand And Recovery Part 1-1 | 00:59:17 |

| 71 Demand And Recovery Part 2-1 | 00:45:32 |

| 72 Demand And Recovery Part 3-1 | 01:12:14 |

| 73 Liability In Certain Cases-1 | 00:33:00 |

| 74. Appeals and Revision part 1 | 01:02:10 |

| 75. Appeals and Revision part 2 | 01:21:12 |

| 76. Penalty and Prosecution | 00:22:15 |

| 77. Transitional Provisions part 1 | 01:11:17 |

| 78. Transitional Provisions part 2 | 00:14:35 |

| 79. Job Work | 00:14:39 |

| 80. Miscellaneous | 00:18:15 |

ABOUT :

CA Farooq Haque

Teaching is an art and it came very naturally to him. He started teaching his classmates while pursuing charted accountancy course. He established Farooq Haque Classes, in the year 1998, with the sole purpose of revolutionizing the way CA,CS and CMA course is taught. Since then he has taught more than 32,500 + students and the most complicated subjects of Direct Taxes, Indirect taxes and Business and corporate laws.

Moreover, he has guided many students in preparing papers for conferences, elocutions and quiz competitions. In last 17 years his students have not only excelled in their examinations (Highest being 1st All India Rank in CA-Final), but also in their professional lives. Large numbers of his students are placed in top managerial positions in Indian and Multinational companies across the globe.

Raman saxena –

Farooq sir lectures at such discounted rate was cherry on cake for me.

No need to tell about farooq sir teaching.

Whole India knows about him.

Thanks CscartIndia